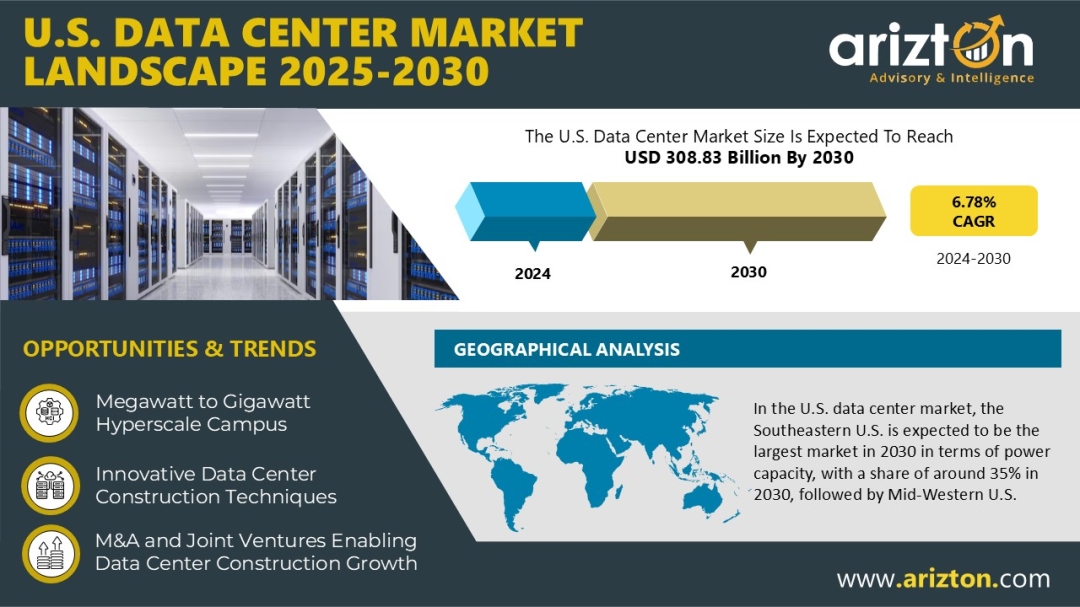

U.S. Data Center Market Investment to Reach USD 208.38 Billion by 2030 – Exclusive Research Report by Arizton

According to Arizton’s latest research report, the U.S. data center market growing at a CAGR of 6.78% during 2024-2030.

Looking for More Information? Click: https://www.arizton.com/market-reports/us-data-center-market-analysis

Report Summary

Market Size by Investment (2030): USD 308.83 Billion

Market Size by Investment (2024): USD 208.38 Billion

CAGR By Investment (2024-2030): 6.78%

Market Size – Area (2030): 35.37 Million Square Feet

Power Capacity (2030): 8,874 MW

Historic Year: 2021-2023

Base Year: 2024

Market Segmentation: Facility Type, Infrastructure, It Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, Cooling Systems, Cooling Techniques, General Construction, Tier Standard, and Geography

Largest Region By Investment: South-Eastern U.S.

Fastest Growing Region By Investment: North-Eastern U.S.

Geographical Analysis: South-Eastern U.S., South-Western U.S., Western U.S., Mid-Western U.S., And North-Eastern U.S.

Market Overview

The U.S. data center market is entering a phase of rapid growth, largely fueled by the rising demand for AI workloads. This surge is prompting major expansions by hyperscale cloud providers, internet service companies, and AI-driven enterprises. Both colocation and self-built data centers are expected to grow steadily between 2025 and 2030, as the need for advanced computing infrastructure continues to rise.

As power availability becomes a critical factor, the market is witnessing a shift from Tier 2 to Tier 3 cities areas that offer better access to the gigawatt-scale capacity needed to support large-scale campuses. In April 2025, the U.S. Department of Energy (DOE) identified 16 potential sites that could support AI-focused data center development, highlighting the growing national focus on meeting energy demands. However, power constraints remain a key challenge. Leading data center hubs, including Virginia, are not expected to see major grid expansions until 2027 or later. Many new data center projects are currently waiting for grid connections, which will play a pivotal role in shaping market growth over the next five years.The industry is also seeing increased momentum through mergers, acquisitions, and joint ventures among major players an ongoing trend that is reshaping the data center construction landscape and accelerating market development.

AI Transforming the Landscape of the Data Center Market

Artificial Intelligence (AI) played a transformative role in the U.S. data center market in 2024, contributing to over 50% of the market’s growth. The year witnessed a significant power capacity addition exceeding 4.5 GW, driven by both colocation providers and hyperscale self-built facilities. The rapid rise of AI technologies spearheaded by innovations like OpenAI’s ChatGPT has elevated AI from a supportive function to a central force reshaping the data center landscape. Despite this surge, AI adoption across industries remains in its infancy; according to the U.S. Census Bureau, only 3.8% of businesses had integrated AI into production processes as of 2024. However, this figure is expected to surge dramatically over the next five years. Further accelerating this shift, OpenAI expanded its data center footprint in October 2024 through strategic collaborations with Oracle and the development of new facilities in Texas. Alongside OpenAI, hyperscale cloud service providers and GPU as a service vendors are also ramping up their infrastructure investments, signaling a robust and AI-driven evolution of the data center market.

Recent developments

-

In September 2024, Google announced the signing of PPAs to acquire solar energy in Nebraska and Texas, with the carbon removal deal in Brazil. In collaboration with the Omaha Public Power District, Google secured an agreement with NextEra Energy to source carbon-free energy from the 420MW Pierce County Energy Center in Nebraska, set tobecome operational in 2027.

-

In FY 2025, Microsoft is expected to spend $80 billion to build out AI data centers to runAI training models as well as its cloud operators worldwide.

-

In March 2025, Crypto and AI data center company IREN announced its plans to develop a 75 MW AI data center in Texas. They are planning to deploy a new 75 MW liquid-cooling data center for AI/High-performance computing at its Childress site in Texas. It will be designed to support 200 kW per rack via direct-to-chip cooling for NVIDIA’s Blackwell GPUs.

Mergers and Joint Ventures Drive U.S. Data Center Growth

The U.S. data center market is growing rapidly, supported by an increase in mergers, acquisitions (M&A), and joint ventures (JVs). These strategic moves are helping companies expand their capacity and keep up with the rising demand for digital infrastructure. As part of this trend, Langan Engineering & Environmental Services recently acquired Navix Engineering, a civil engineering firm with experience in data center projects across many U.S. states. In another development, IQ Fiber, a Florida-based internet provider, acquired ThinkBig Networks LLC, with support from equity funding by SDC Capital Partners, strengthening its fiber network reach.Additionally, TECfusions secured a $300 million loan to expand its data center in Clarksville, Virginia. With $160 million already iallocated, the funding will help complete the first phase of the project, increasing the facility’s power capacity to 37.5MW. These partnerships and investments reflect the industry’s focus on building scalable, high-performance data centers to support the growing needs of businesses and technology platforms.

Regional Insights Shaping the Future of U.S. Data Centers

The U.S. data center market is witnessing dynamic growth across various regions, each contributing uniquely to the industry’s expansion. The Southeastern U.S. is projected to lead in power capacity by 2030, driven by increasing investments and infrastructure development. Virginia continues to dominate hyperscale activity, attracting major players like Microsoft, AWS, and Google. In the Midwest, states such as Illinois, Iowa, and Ohio are leveraging tax incentives to boost data center investments. Meanwhile, Texas and Arizona stand out in the Southwest, accounting for the majority of regional investments, with growing interest from colocation, hyperscale, and bitcoin operators. The Western region is also seeing strong momentum, especially in Oregon, California, and Utah, fueled by hyperscale developments. Additionally, the New York-New Jersey area remains a critical data center hub, with high demand and low vacancy rates reinforcing its role in the nation’s digital infrastructure.

The Report Includes the Investment in the Following Areas:

Market Segmentation & Forecast

-

Hyperscale Data Centers

-

Colocation Data Centers

-

Enterprise Data Centers

Infrastructure

-

IT Infrastructure

-

Electrical Infrastructure

-

Mechanical Infrastructure

-

General Construction

Segmentation by IT Infrastructure

-

Server Infrastructure

-

Storage Infrastructure

-

Network Infrastructure

Segmentation by Electrical Infrastructure

-

UPS Systems

-

Generators

-

Transfer Switches & Switchgear

-

Power Distribution Units

-

Other Electrical Infrastructure

Segmentation by Mechanical Infrastructure

-

Cooling Systems

-

Racks

-

Other Mechanical Infrastructure

Segmentation by Cooling Systems

-

CRAC & CRAH Units

-

Chiller Units

-

Cooling Towers, Condensers, and Dry Coolers

-

Other Cooling Units

Segmentation by Cooling Techniques

-

Air-based

-

Liquid-based

Segmentation by General Construction

-

Core & Shell Development

-

Installation & Commissioning Services

-

Engineering & Building Design

-

Physical Security

-

Fire Detection & Suppression

-

DCIM/BMS

Segmentation by Tier Standard

-

Tier I & II

-

Tier III

-

Tier IV

Segmentation by Geography

-

The U.S.

-

South-Eastern U.S.

-

South-Western U.S.

-

Western U.S.

-

Mid-Western U.S.

-

North-Eastern U.S.

Vendor Landscape

IT Infrastructure Provider

-

Arista Networks

-

Atos

-

Broadcom

-

Cisco Systems

-

DataDirect Networks (DDN)

-

Dell Technologies

-

Extreme Networks

-

Fujitsu

-

Hewlett Packard Enterprise

-

Hitachi Vantara,

-

IBM

-

Infortrend Technology

-

Inspur

-

Intel

-

Lenovo

-

Micron Technology

-

MiTAC Holdings

-

NetApp

-

Nimbus Data

-

NVIDIA

-

Oracle

-

Pure Storage

-

Quanta Cloud Technology

-

QNAP Systems

-

Quantum

-

Seagate Technology

-

Silk

-

Super Micro Computer

-

Synology

-

Toshiba

-

Western Digital

-

Wiwynn

-

Hon Hai Technology Group (Foxconn)

Data Center Support Infrastructure Providers

-

ABB

-

Caterpillar

-

Cummins

-

Delta Electronics

-

Eaton

-

Legrand

-

Rolls-Royce

-

Schneider Electric

-

STULZ

-

Vertiv

Other Data Center Support Infrastructure Providers

-

Airedale

-

Alfa Laval

-

Asetek

-

Bloom Energy

-

Carrier

-

Condair

-

Cormant

-

Cyber Power Systems

-

Enlogic

-

FNT Software

-

Generac Power Systems

-

Green Revolution Cooling (GRC)

-

HITEC Power Protection

-

Johnson Controls

-

KOHLER (Rehlko)

-

KyotoCooling

-

Mitsubishi Electric

-

Natron Energy

-

NetZoom

-

Nlyte Software

-

Rittal

-

Siemens

-

Trane

-

ZincFive,

-

HIMOINSA (Yanmar)

Data Center Construction Contractors

-

AECOM

-

Ames Construction

-

Arup

-

Barge Design Solutions

-

Burns & McDonnell

-

Corgan

-

DPR Construction

-

Fortis Construction

-

Haydon

-

Holder Construction

-

Jacobs

-

KDC

-

Kiewit Corporation

-

Lewis Michael Consultants

-

Morgan Construction

-

Morgan Corp

-

Page

-

Rogers-O’Brien Construction

-

Rosendin Electric

-

Syska Hennessy Group

-

Turner Construction

Other Data Center Construction Contractors

-

AlfaTech

-

Black & Veatch

-

BlueScope Construction

-

Brasfield & Gorrie

-

CallisonRTKL

-

Clark Construction Group

-

Clayco

-

Climatec

-

Clune Construction

-

EMCOR Group

-

EYP MCF

-

Fitzpatrick Architects

-

Fluor Corporation

-

Gensler

-

Gilbane Building Company

-

Gray

-

HDR

-

Hensel Phelps

-

HITT Contracting

-

Hoffman Construction

-

JE Dunn Construction

-

JHET Architects,

-

kW Engineering

-

Walbridge

-

WSP

-

Linesight,

-

M+W Group (Exyte)

-

McCarthy Building Companies

-

Morrison Hershfield

-

Mortenson

-

Pepper Construction

-

Rosendin

-

Ryan Companies

-

Salute Mission Critical

-

Sheehan Nagle Hartray Architects

-

Skanska

-

Southland Industries

-

Sturgeon Electric Company

-

Structure Tone

-

Suffolk Construction

-

Sundt Construction

-

The Mulhern Group

-

The Walsh Group

-

The Weitz Company

-

TRINITY Group Construction

Data Center Investors

-

Apple

-

Applied Digital

-

AWS

-

CyrusOne

-

DataBank

-

Digital Realty

-

Equinix

-

Google

-

Meta (Facebook)

-

Microsoft

-

NTT DATA

-

Aligned Data Centers

-

American Tower

-

AUBix

-

CloudHQ

-

Cologix

-

Compass Datacenters

-

COPT Data Center Solutions

-

CoreSite

-

Core Scientific

-

DartPoints

-

DC BLOX

-

DigiPower X

-

Edge Centres

-

EdgeConneX

-

EdgeCore Digital Infrastructure

-

Element Critical

-

Evoque

-

Flexential

-

fifteenfortyseven Critical Systems Realty (1547)

-

H5 Data Centers

-

HostDime

-

Hut 8

-

Iron Mountain

-

Netrality Data Centres

-

Novva Data Centers

-

PhoenixNAP

-

PowerHouse Data Centers

-

Prime Data Centers

-

Sabey Data Centers

-

QTS Realty Trust

-

Skybox Datacenters

-

Stream Data Centers,

-

STACK Infrastructure

-

Switch

-

T5 Data Centers

-

TierPoint

-

Vantage Data Centers

-

Yondr

-

365 Data Centers

-

5C Data Centers

New Entrants

-

Ardent Data Centers

-

Colovore

-

CloudBurst Data Centers,

-

Crane Data Centers,

-

Edged Energy

-

NE Edge

-

Prometheus Hyperscale

-

Quantum Loophole

-

Rowan Digital Infrastructure

-

Tract

In a nutshell, the Arizton Advisory & Intelligence market research report provides valuable market insights for industry stakeholders, investors, researchers, consultants, and business strategists aiming to gain a thorough understanding of the U.S. data center market. Request for Free Sample to get a glance of the report now: https://www.arizton.com/market-reports/us-data-center-market-analysis

Other Related Reports that Might be of Your Business Requirement

U.S. Data Center Construction Market – Industry Outlook & Forecast 2025-2030

https://www.arizton.com/market-reports/united-states-data-center-construction-market-2024

Key Questions Answered in the Report:

How big is the U.S. data center market?

What is the growth rate of the U.S. data center market?

What is the estimated market size in terms of area in the U.S. data center market by 2030?

What are the key trends in the U.S. data center market?

How many MW of power capacity is expected to reach the U.S. data center market by 2030?

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

-

1hr of free analyst discussion

-

10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/us-data-center-market-analysis